80% of People Have a Mistaken Understanding of the Relationship Between Money and the Economy

In this article, I’m going to walk you through how most of us were taught to envision the relationship between money and the economy. Then, I’m going to offer an alternative visualization that is more accurate to the reality of how money actually flows in and out of our economy. For those in a hurry, here’s a quick summary:

Let’s start with what we’ve been taught

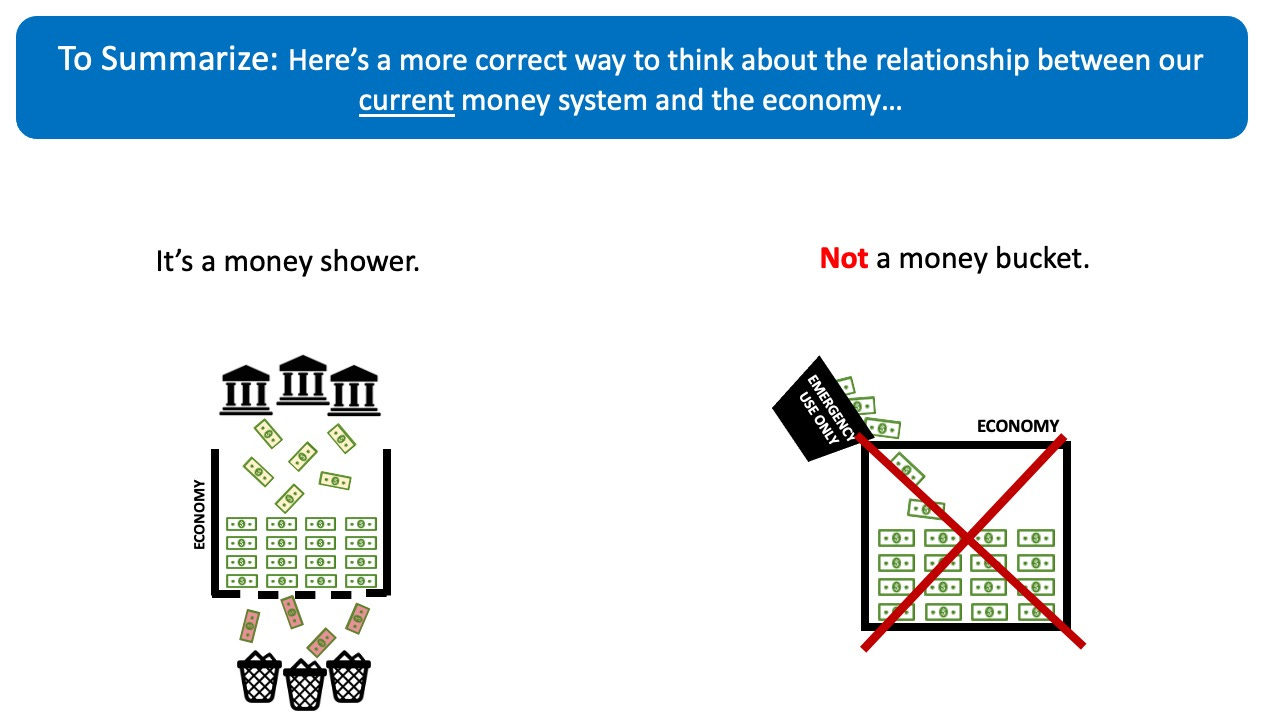

Research shows that the vast majority of us (80%) think that our government is the only one that can create new money and add it into circulation. Furthermore, we believe that governments generally only create and add new money into circulation in the event of an emergency, like during a pandemic or a war. We’ve been told that any time new money is created it is inflationary. So, most of us think that there is a fairly stable amount of money in circulation.

Much to my surprise, I discovered a few years ago that all of that is wrong. I’ve spent the last 18 months reading dozens of books and hundreds of academic articles trying to make sense of the truth that…

“The actual process of money creation takes place primarily in banks.”

As I have worked to make sense of how money creation actually works, I’ve also had to completely re-think how I visualized the relationship between money and the economy. The below series of visualizations is simplified, but I believe that it reveals a few dynamics far more accurately than what is taught in many economics textbooks today.

Visualizing the Relationship Between Money and the Economy

Let’s begin with what most of us are taught…

What Most of Us Were Taught

The True Story

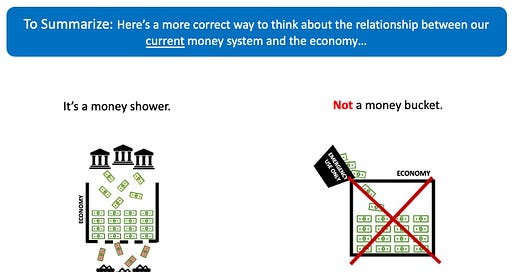

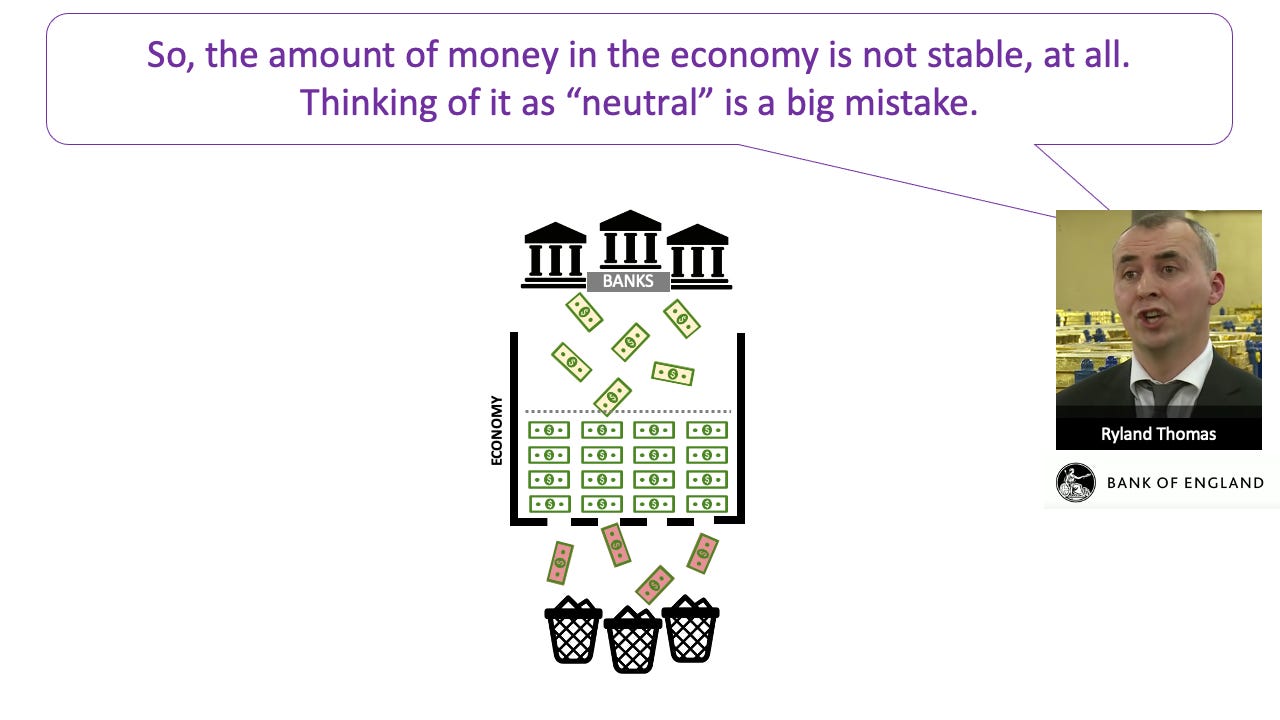

The Money Shower: Inflow vs Outflow

The Money Shower & Financial Crises

Why This Matters: Inflation vs Deflation

Curing Recessions Caused by Deflationary Debt Spirals

A Non-visual Explanation

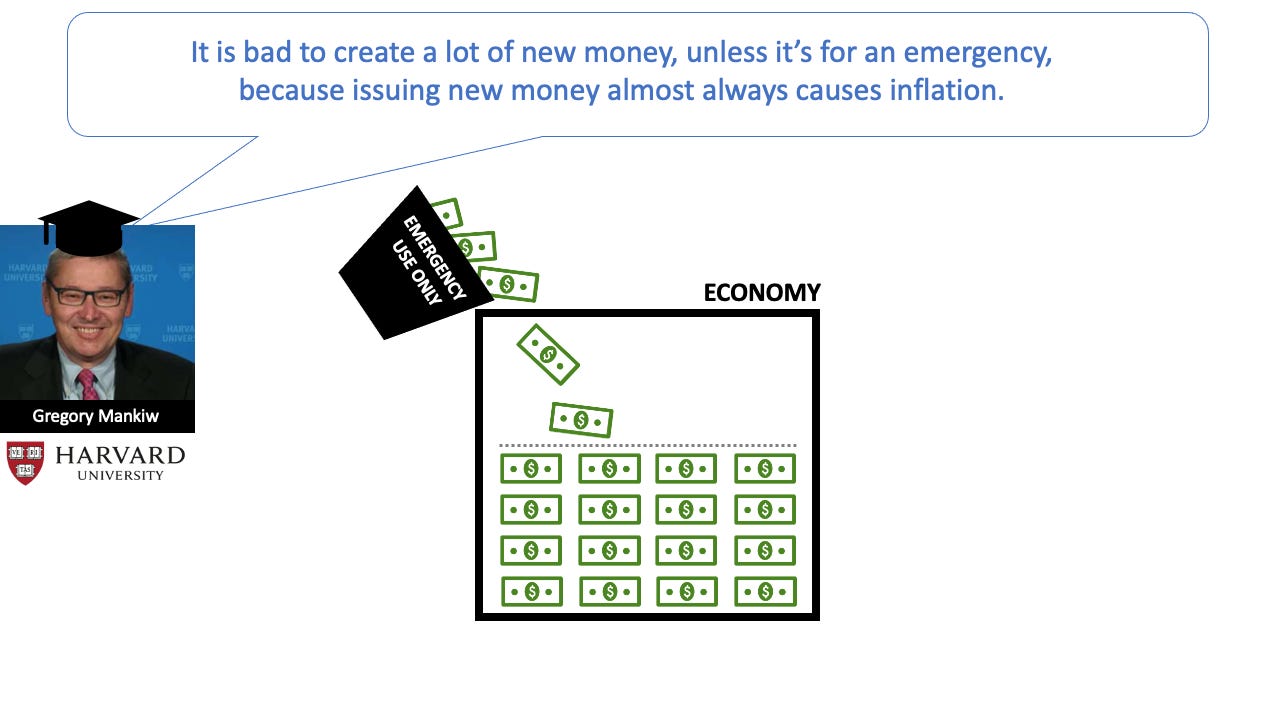

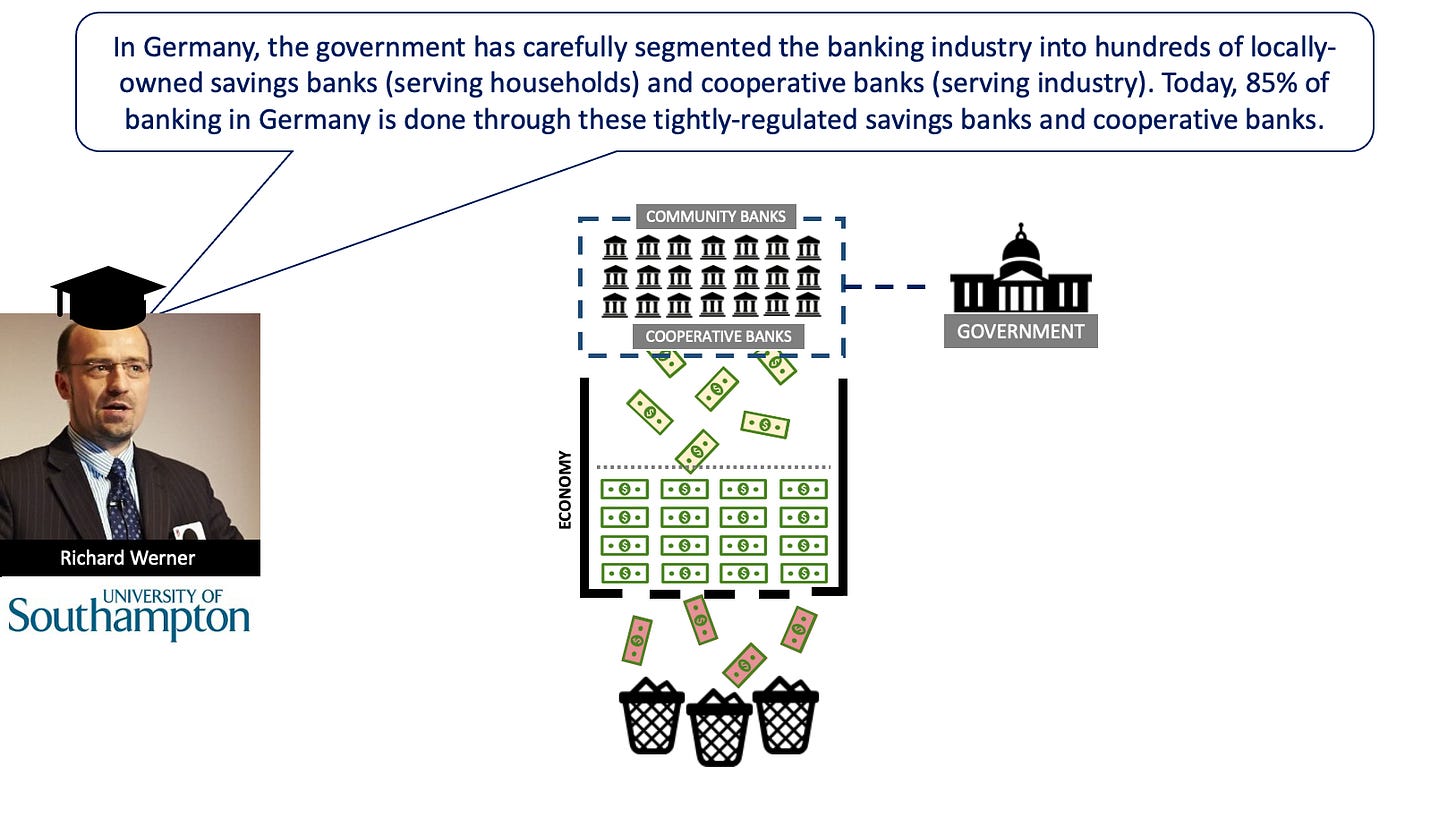

According to the Federal Reserve, the Bank of England, and many other central banks around the world, huge amounts of money are being added and deleted from the economy by commercial banks all the time – in good times and bad. Most of us don’t know about this because mainstream economics textbooks and courses teach falsehoods about how commercial banks work.

In contrast to what mainstream textbooks teach, banks do not lend out depositor’s savings or “multiply up” central bank reserves or do “fractional reserve” lending. Instead, banks create brand new money when they make loans or buy bonds by simply typing additional numbers into their customer’s bank account. Over 90% of the money in circulation only exists as digital entries in bank accounting systems.

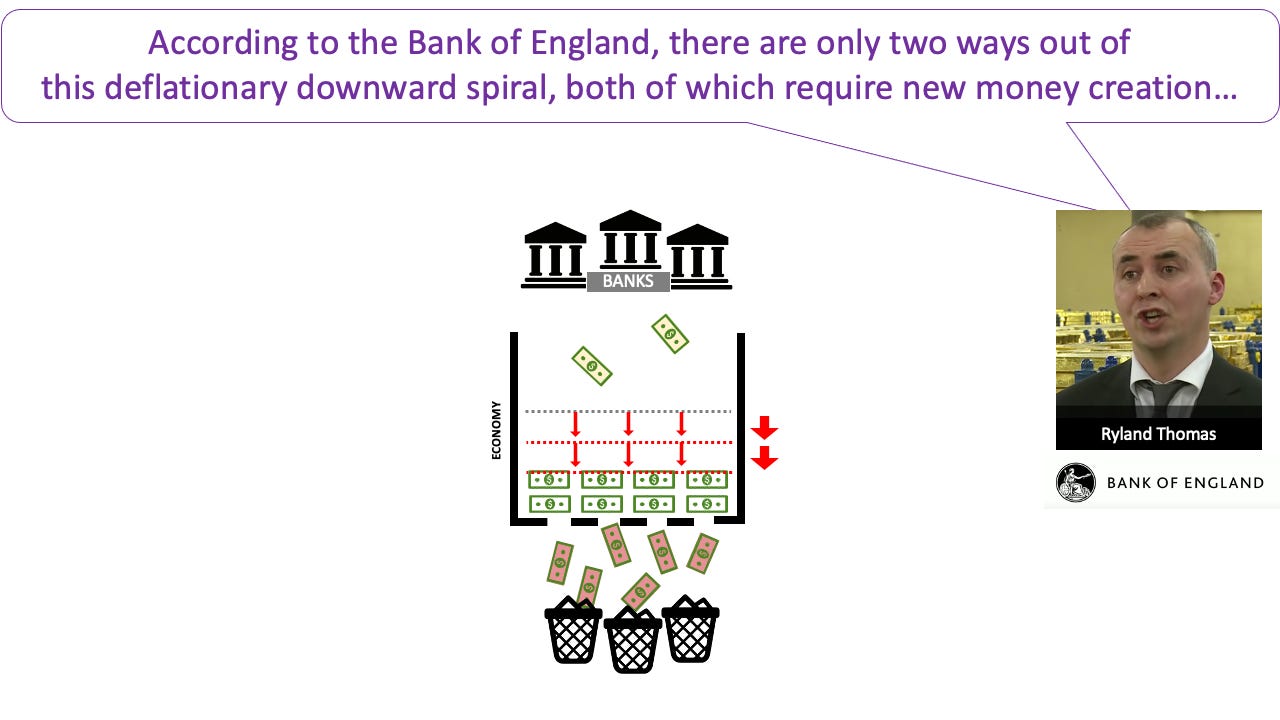

The digital entries in bank accounting systems actually represent bank credit, not money, but our governments and courts have allowed bank credit to become equivalent to money for the purposes of paying taxes and all debts. The reason this is important is that when you repay a loan to a bank, the bank credit that was created when you took out the loan is extinguished. In other words, the amount of money in circulation goes down when debts are repaid.

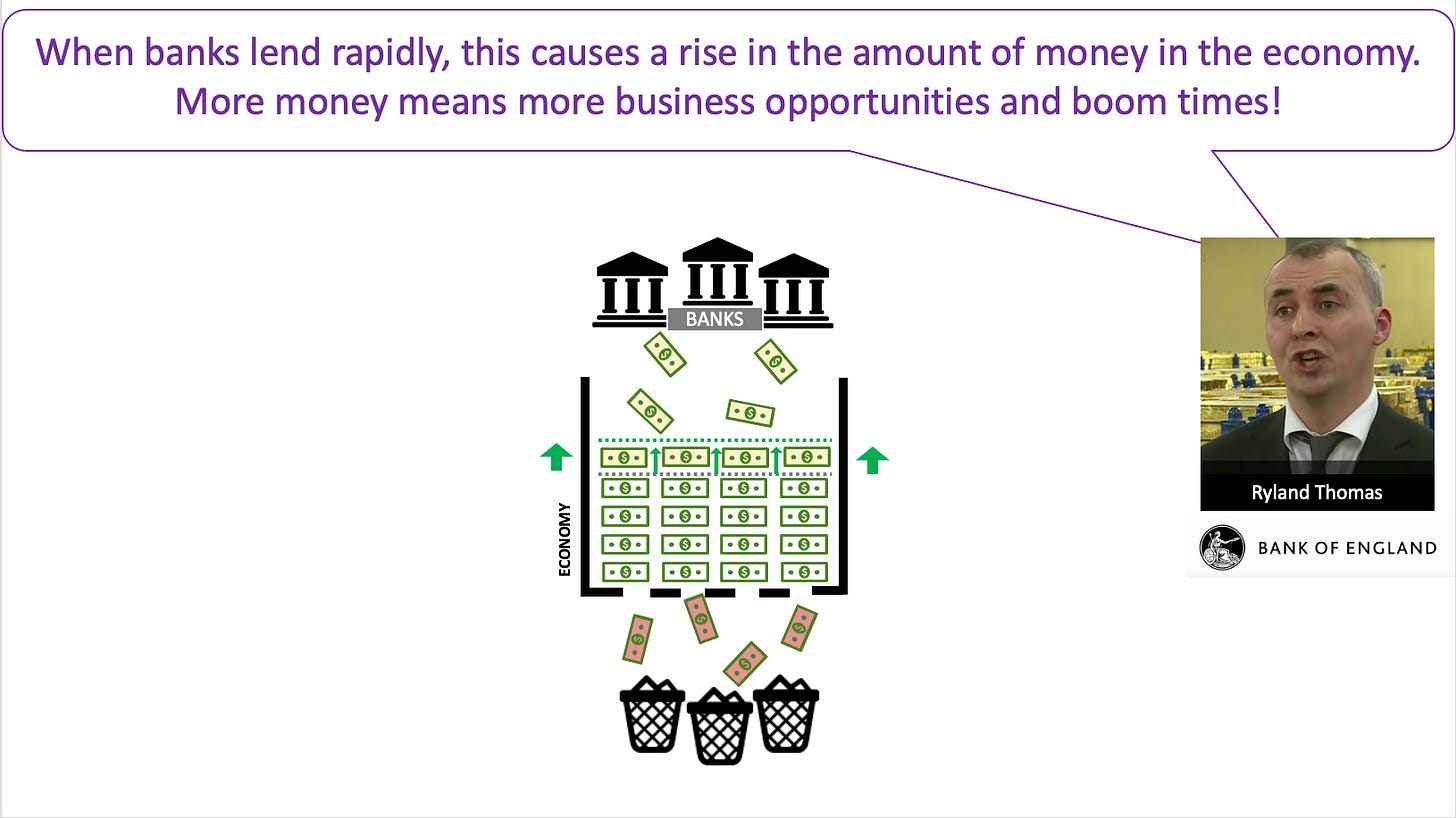

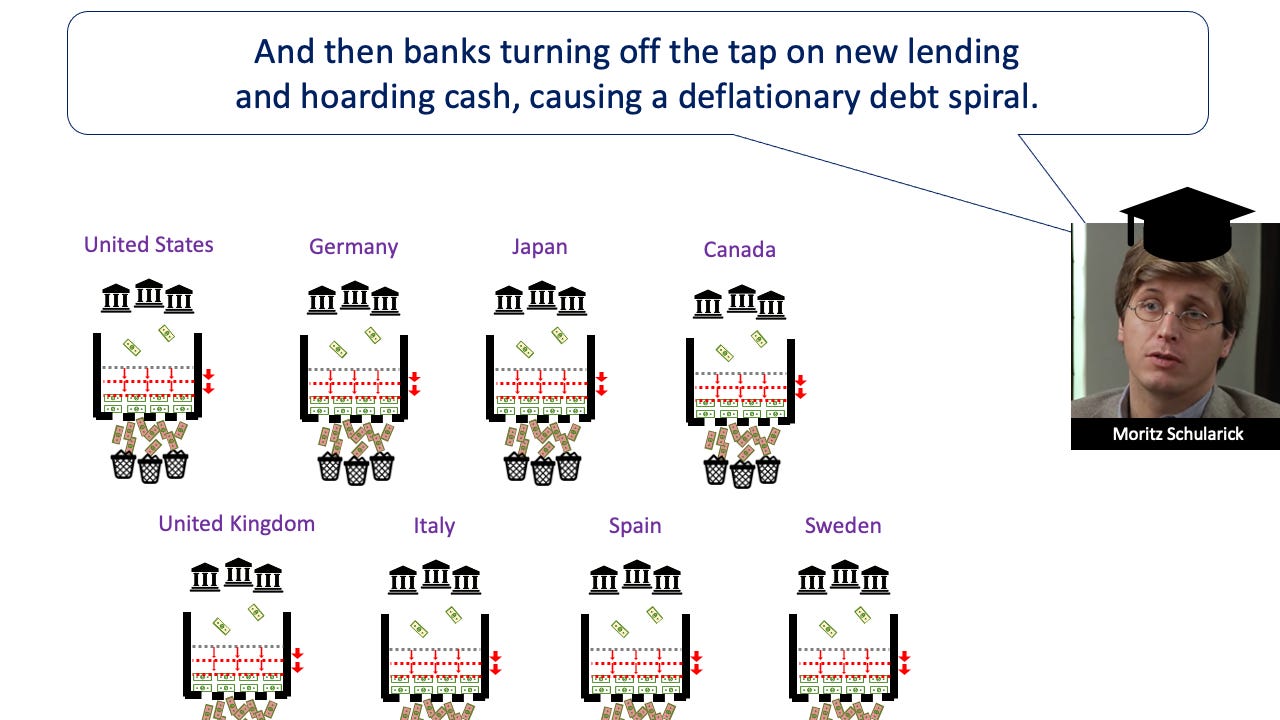

What this means is that the amount of money in circulation in the economy at any time depends on how much lending and debt-collecting the commercial banks are doing. Economists have discovered that the fluctuations in bank lending can cause big swings in the amount of money in circulation, up and down, causing shocks to the financial system that create economic recessions.