Global Study on Monetary Literacy Finds Massive Illiteracy & Disapproval

Why You Should Read This Post

This post provides a high-level summary of a little-known but very important study. The 2014 study, titled Knowledge About Who Creates Money Low Amongst International Population, revealed that 80% of us are misinformed about where money comes from. And not just a little misinformed. Misinformed in ways that really screw up our understanding of how and why the economy works the way it does. This is a tragedy because everyone whose livelihood depends on money has a right to know the truth about where money comes from. Reading this post can make sure that you have the correct information. The conclusion of the post will give you ideas for what you can do to help everybody learn the correct information.

Summary of the Study

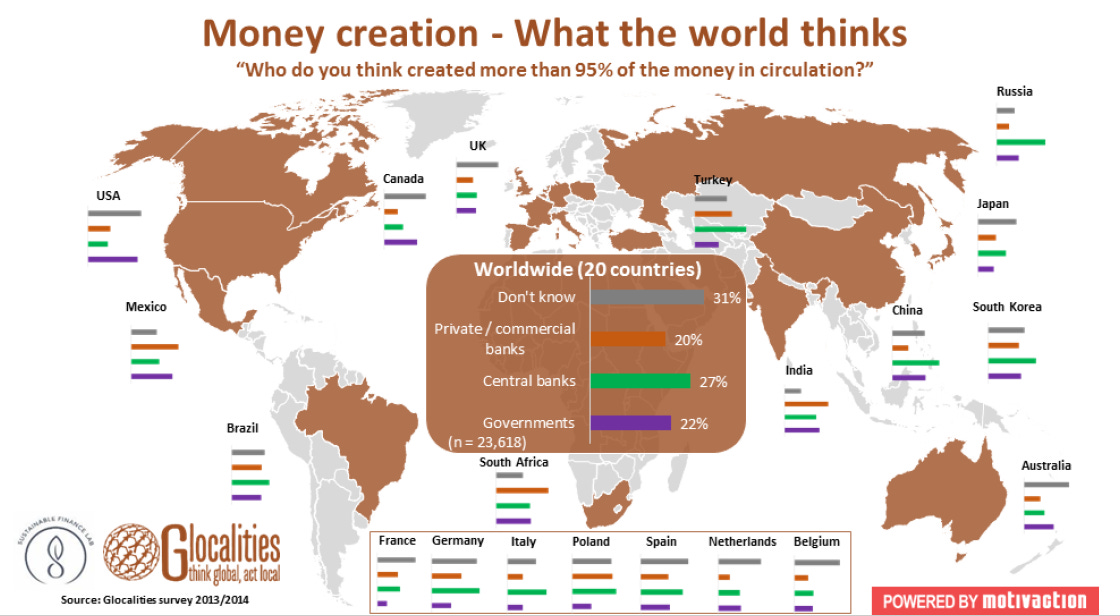

An international survey of 23,000 people in 20 of the world’s largest national economies found a huge mismatch between how people think money is created today, how money is actually created, and how people want money to be created:

Only 20% of people have the correct understanding that private/commercial banks create the vast majority of the money in circulation today.

Only 13% of people believe that private/commercial banks should have the power to create new money, while 59% believe that the power to create new money should belong to a public institution (the government or central bank).

Additional Insights

Half of people believe incorrectly that a government-established institution (either a central bank or the government’s treasury) creates most of the money in their country.

30% of people say they have no idea who creates most of the money in circulation.

63% of the people who correctly understood that private/commercial banks create most money today wanted to see that responsibility transferred to a public institution (governments or central banks).

Even among people who work in the financial sector only 26% (in Western economies) are aware that private/commercial banks create most of the money.

Only 16% of financial sector workers believe private/commercial banks should be the ones creating most of the money.

There are important differences between countries:

Citizens in the Netherlands, Russia, China and the US had the least awareness that private/commercial banks create the majority of their country’s money (12%, 12%, 13%, 15% respectively).

South Africa, India, and Mexico have populations with the highest awareness that private/commercial banks are the creators of their nation’s money supply, though still a small minority of their total population (35%, 34%, and 33% respectively).

Overall, only a small minority of the population in every country surveyed had a correct understanding of money creation in their country.

Quotes from the Study

The main conclusion from the analyses is that there is a lot of misunderstanding and a low level of knowledge in the general population worldwide about who actually creates money.

The findings show that the public opinion on who should create most of the money is starkly different from how money creation is currently organized. The public majority (59%) wants to assign the responsibility for money creation to a public institution (government or central bank) and only a minority (13%) of people want private/commercial banks to be responsible for creating most of the money (as currently is the case).

Low awareness of how the process of money creation works contribute to the growth and acceptance of large ‘’bubbles’’ in the global financial system, that are likely to lead to new crises in the future.

My Big Take-aways

The circumstance that this paper describes is totally unacceptable. Most people in industrialized and urbanized societies depend upon money to meet their basic needs. Therefore, everyone has a right to correct information about the origins of money.

There is an urgent need for this confusion to be clarified. As the Glocalities report states, without a correct understanding of commercial bank money creation and its role in causing economic and environmental crises, people will continue to blame the wrong people (governments, consumers, foreign countries, workers, immigrants, Jews, etc) for crises that are being generated by the lending decisions of commercial banks.

In the last 40 years, there have been hundreds of banking-related economic crises in countries around the globe. But what most people don’t know is that in the prior 30 years, from 1940 to 1973, there were “virtually zero” such crises in the very same countries. The major difference between the periods was not the use of the gold standard, as many people claim today (often while promoting investments in gold and Bitcoins). There were many factors that played into the “Glorious Thirty” or “Golden Age” of financial stability between 1940 and 1970. However, few economic historians dispute that the most significant stabilizing factor was “financial repression”, meaning strong regulation of the financial sector’s ability to create money and fuel speculation.

The fact that people do not know that private/commercial banks create money when making loans means that they also do not know that the repayment of loans uncreates money. This means that they also do not understand that money is being created and uncreated in vast quantities all the time (not just in times of crisis). In other words, addressing the misunderstanding about money creation opens the door to the correct understanding that money does not “circulate inside the economy” the way most people think. Instead, money flows constantly in and out of existence, from source (bank lending) to drain (bank loan repayment). It is an invisible current that powerfully shapes our economic lives.

What Should I Do With This Information?

Consider whether you think everyone deserves to have correct information about how money comes into existence. If you believe, as I do, that everyone whose life and livelihood depends on money has a right to correct information about where it comes from, share this post with others.

As we’ll see in later posts, the way in which commercial banks have created booms and busts via their lending practices has played a crucial role in many of the 400+ economic crises that countries have faced since the 1980s. We’ll also see that the confusion over who creates the money supply is not accidental, at all.