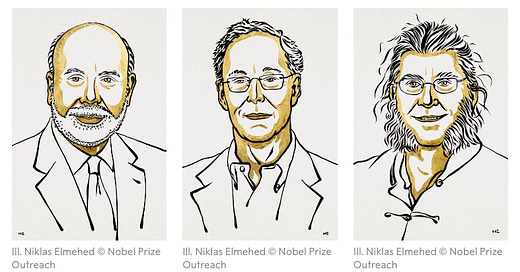

A number of economists were outraged by the Nobel Prize committee’s recent awarding of the 2022 Nobel Prize to Ben Bernanke. They say that Bernanke and the two other prize winners use models of the economy that misrepresent how banking and money creation actually work. These dissenting economists believe the Nobel-winning papers actually confuse and mislead the public and policy makers about the cause of financial crises and how to guard against them. That’s a far cry from the Nobel Prize committee’s claim that Bernanke and the two others revealed important truths about “banks and financial crises”. What’s all the fuss about?

Public Outrage

First off, here are just a few public statements made by economists in the days after the announcement:

“Bernanke (and his two companions) have preserved false ways of thinking about banks and financial crises, and suppressed realistic models of banking and financial crises.” - Steve Keen, Distinguished Research Fellow, University College of London

“The Nobel went to a flat-earth theory of banking that most everyone knows is wrong” - Pavlina Tcherneva, Research Associate, Levy Economics Institute at Bard College

“It might seem bizarre to a non-economist that the Bank of Sweden Nobel Memorial award for economics has been given to people who wrote a model of banking in which money does not exist. I will leave it at that.” - Steven Hail, Lecturer in Economics, Torrens University

“The decision to award the ‘Nobel Prize’ to former Federal Reserve Chairman Ben Bernanke is not only an odd one… but a dangerous one as well. ‘Nobel Prizes’ go a long way in seemingly legitimizing the views of the recipients, and when they are awarded to someone for ‘research on banks and financial crises’ that is fundamentally flawed, incorrect, and quite simply wrong, the results can be disastrous.” – Louis-Philippe Rochon, Full Professor of Economics, Laurentian University and Editor-in-Chief, Review of Political Economy

“The model perpetuates a view of banking which has been shown to be wrong time and time again. In this view, banks receive money from depositors which they lend out to borrowers. A well-known bulletin by the Bank of England put lie to this.” - Rethinking Economics (association of economics students)

“Bernanke’s Nobel prize is harmful because it rewards faulty thinking on how banks actually work” - Frances Coppola, MarketWatch

“The core argument that banks act merely as intermediaries between savers and investors deliberately neglects the extent to which banks create money ex nihilo.” - David Fields, Monetary Policy Institute.

"A Nobel Award for the Wrong Model: Diamond-Dybvig-Bernanke is a flawed model of banking that has no room for a lender of last resort”, Peter Bofinger, Professor of Economics, Money and International Economic Relations, University of Würzburg

What’s wrong with Bernanke’s models?

Some of these economists’ wrote detailed explanations of why Bernanke and the other prize winners’ models are fundamentally flawed. Many of their explanations are written in academic language and engage in theoretical debates that are difficult for a general audience to understand. Here is what is wrong with the Nobel Prize winners’ models in a nutshell:

Ben Bernanke and the two other award winners believe that banks take in deposits from savers and lend those deposits out to borrowers. The mathematical models that underpin their research assume this is how banking works. However…

This is not how banks actually work. In the real world, banks create new money every time they make a loan and destroy money every time a loan’s principal is repaid. This means that the relationship between banking, money, and the economy is fundamentally different than what Bernanke and the two other prize winners assumed.

Whether the Nobel Prize winners’ assumption that banks lend out depositors’ savings is correct or incorrect is not a matter for debate. It is definitively incorrect. In 2014, an empirical examination of bank accounting software verified that banks create fresh new money every time they make a loan. Dozens of authoritative sources from central banking, banking, law, and economics have also confirmed that this is the correct understanding of how banking works.

Why does it matter that Bernanke’s models are wrong?

First off, Bernanke’s model failed in 2008 to predict the financial crisis. Today, his model will still fail to predict financial crises caused by contractions in bank lending. It is, in fact, mathematically incapable of predicting or explaining crises driven by the credit expansion and contraction in the banking sector (which are the most destructive kind of financial recessions). This is because bank money creation and destruction is not included as a variable in his model’s equations and datasets. The same is true for the models of the two other 2022 Nobel Prize winners in economics.

Secondly, Bernanke’s models lead to incorrect beliefs about how to prevent future bank-led financial crises. For example, his supposedly ground-breaking idea that deposit insurance will prevent widespread financial crises was proven false by the 2008 crisis. Deposit insurance did not stop runs on individual banks by large depositors until governments stepped in to guarantee the entire banking sector. Most importantly, deposit insurance does nothing to stop creditor runs, which were the major impetus for the 2008 crisis. 1 2 3